eToro Group Limited is brokerage company which was founded in 2007 with the vision of opening up capital markets. The social investment network offers users a choice of which assets to invest in from commission-free fractional equities to cryptoassets,

and a choice of how to invest.

Users can trade directly themselves, invest in a smart portfolio, or replicate the investment strategy of successful investors on the platform at no extra cost with the simple click of a button.

Profile of eToro Group Limited

eToro is a multi-asset investment platform that empowers people to grow their knowledge and wealth as part of a global community of successful investors. eToro was founded in 2007 with the vision of opening up the global markets so that everyone can trade and invest in a simple and transparent way.

Today, eToro is a global community of more than 20 million registered users who share their investment strategies; and anyone can follow the approaches of those who have been the most successful. Due to the simplicity of the platform users can easily buy, hold and sell assets, monitor their portfolio in real time, and transact

whenever they want.

FinTech Acquisition Corp

FinTech Acquisition Corp. V is a special purpose acquisition company led by Betsy Z. Cohen as Chairman of the Board, Daniel G. Cohen, as Chief Executive Officer and James J. McEntee, III as President formed for the purpose of entering into a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, with a focus on the financial technology industry.

The company raised $250,000,000 in its initial public offering in December 2020 and is listed on the NASDAQ under the symbol “FTCV”.

eToro Group Ltd is a multi-asset investment platform that empowers people to grow their knowledge and wealth as part of a global community of successful investors, and FinTech Acquisition Corp. V (NASDAQ: FTCV) (“FinTech V”), a publicly-traded

special purpose acquisition company, announced today that they have entered into a definitive business combination agreement.

Upon closing of the transaction, the combined company will operate as eToro Group Ltd. and is expected to be listed on NASDAQ. A global platform regulated in the U.K., Europe, Australia, the U.S. and Gibraltar

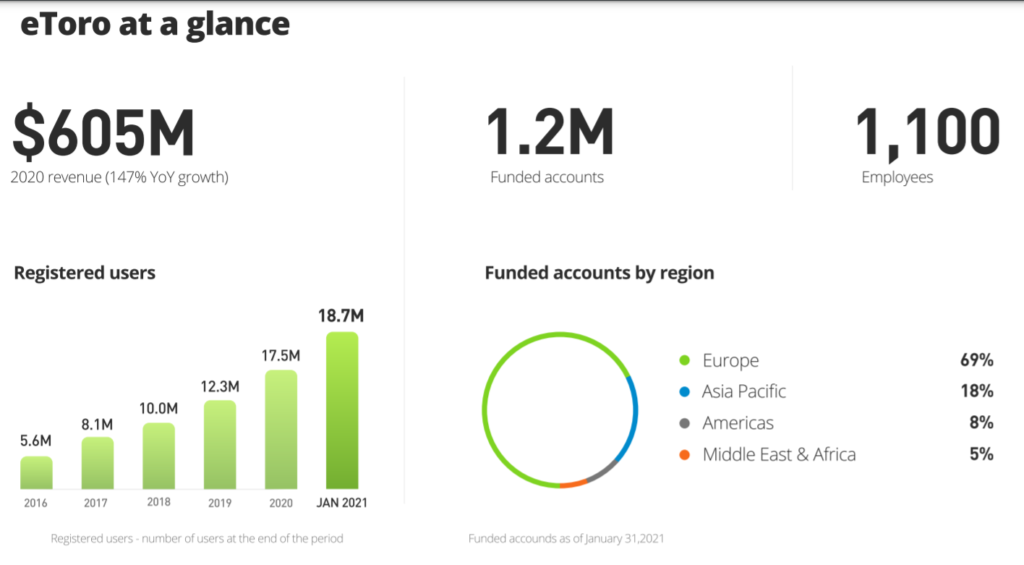

eToro Revenue and users

In 2020, eToro added over 5 million new registered users and generated gross revenues of $605 million, representing year-over-year growth of 147%. Momentum is accelerating in 2021 as a new generation of investors discover the global markets. In 2019, monthly registrations averaged 192,000.

- Equity value of approximately $10.4 billion

- Gross revenues of $605 million

- World’s leading social investment network with more than 20 million registered users from over 100 countries.

In 2020, that grew to 440,000, and in January 2021 alone eToro added more than 1.2 million new registered users to the social network. In 2019, eToro executed 8 million trades per month on average. That number grew to 27 million in 2020, and in January 2021 alone eToro saw more than 75 million trades executed on the eToro platform.

eToro currently has over 20 million registered users and its social community is rapidly expanding due to the vast, and growing, total addressable market which is supported by secular trends such as the growth of digital wealth platforms and the rise in retail participation. eToro was also one of the first regulated platforms to offer cryptoassets and is well-positioned to benefit from mainstream crypto adoption.

Existing eToro equity holders, including current investors and employees of the firm, will remain the largest investors in the combined company retaining approximately 91% ownership immediately following the business combination (assuming no redemptions by FinTech V’s stockholders).