Just Eat Takeaway.com stands as a pioneering force in the global on-demand delivery landscape, seamlessly connecting vibrant ecosystems of consumers, partners, and couriers to redefine convenience in daily life. From the bustling streets of Amsterdam to the diverse markets across Europe, North America, and beyond, Just Eat Takeaway.com’s innovative platform facilitates effortless access to a world of culinary delights, groceries, retail essentials, and more. With a robust business model centered on hyper-local relevance and technological prowess, the company continues to drive sustainable growth, operational efficiency, and unparalleled user experiences. This comprehensive exploration delves into Just Eat Takeaway.com’s business segments, revenue dynamics, product and service offerings, storied history, brand portfolio, geographical footprint, financial performance, subsidiary ecosystem, physical infrastructure, founding vision, leadership structure, shareholding landscape, investment strategy, and forward-looking investment plans—unveiling the pillars that sustain its leadership in the competitive delivery arena.

Business Segments: Comprehensive Overview and Revenue Breakup

Just Eat Takeaway.com’s operations are strategically segmented to maximize market penetration and operational synergy, reflecting a diversified approach to on-demand delivery. As of December 31, 2024, the company operates across four primary segments: Northern Europe, United Kingdom and Ireland, Southern Europe and Australia, and North America. These segments are designed to leverage regional strengths, adapt to local consumer preferences, and capitalize on dense logistics networks for efficient service delivery. Each segment contributes uniquely to the overall Gross Transaction Value (GTV), underscoring Just Eat Takeaway.com’s global scale while maintaining hyper-local focus.

The Northern Europe segment encompasses Austria, Belgium, Denmark, Germany, Luxembourg, the Netherlands, Poland, Slovakia, and Switzerland. This mature market benefits from high digital adoption and strong brand loyalty, driving consistent performance through expanded non-food offerings like groceries and retail. In 2024, Northern Europe generated €8.0 billion in GTV, representing 31% of the group’s total €26.3 billion GTV. Revenue dynamics here are bolstered by commission-based models, with ancillary streams from advertising and payment processing adding resilience. The segment’s emphasis on unified app experiences and loyalty programs, such as JET+, has enhanced consumer retention, contributing to a 4% constant currency GTV growth year-over-year.

The United Kingdom and Ireland segment operates in a highly competitive landscape, focusing on urban density and diverse partner networks. Key initiatives include streamlining delivery models to contractor-based operations, which improved cost efficiencies and order fulfillment. GTV reached €7.1 billion in 2024, accounting for 27% of total group GTV. Revenue breakup highlights order-driven commissions at approximately 85%, supplemented by 15% from consumer fees and advertising. Adjusted EBITDA for this segment surged to €219 million, reflecting a margin expansion to 3.1% from 2.0% in 2023, driven by enhanced pooling and promotional optimizations. Just Eat Takeaway.com’s UEFA sponsorship further amplified brand visibility, fostering a 4% constant currency GTV uplift.

Southern Europe and Australia, including Australia, Bulgaria, Israel, Italy, and Spain, represent emerging growth hubs with untapped potential in non-food verticals. Despite challenges from market exits in New Zealand and France, the segment posted €1.8 billion in GTV, comprising 7% of the group’s total. Revenue streams mirror the group’s model, with commissions dominating at 82%, bolstered by 18% from delivery fees in Scoober-operated markets. Adjusted EBITDA improved marginally to -€80 million, with a focus on operational streamlining yielding a -4.3% margin. Constant currency GTV declined 11%, yet strategic investments in app unification position this segment for recovery through expanded partner ecosystems.

North America, encompassing Canada and the United States (prior to the Grubhub divestiture), delivered €9.3 billion in GTV, holding 36% of group totals. This segment’s revenue profile features 78% from commissions, with 22% from advertising amid a maturing campus delivery model. Adjusted EBITDA rose to €170 million, achieving a 1.8% margin up from 1.2%, fueled by marketing efficiencies and overhead optimizations. Despite a 9% GTV drop, the segment’s scale underscores Just Eat Takeaway.com’s North American legacy, with post-divestiture focus shifting resources to core European strengths.

Collectively, these segments generated €26.3 billion in GTV, a -1% year-over-year shift (-2% constant currency), with Northern Europe and UK/Ireland offsetting declines elsewhere. Revenue totaled €5,085 million (-1%), with order-driven streams at 96% (€4,964 million) and ancillary at 4% (€121 million). Adjusted EBITDA climbed to €460 million (1.7% of GTV), signaling profitability strides amid portfolio refinements. Just Eat Takeaway.com’s segment strategy emphasizes network effects, where partner expansion fuels consumer engagement, yielding scalable margins and resilient revenue streams across geographies.

In-depth segment analysis reveals Northern Europe’s dominance in profitability, with €371 million adjusted EBITDA (4.6% margin), driven by dense urban logistics and 95,000 partners. UK/Ireland’s transformation to single-delivery models slashed costs, boosting €219 million EBITDA. Southern Europe’s -€80 million reflects scaling investments, while North America’s €170 million highlights advertising leverage. Revenue breakup uniformity—commissions (82-85%), fees (10-15%), advertising (5-8%)—ensures diversified income, with GTV per segment underscoring balanced growth. Just Eat Takeaway.com’s segments not only delineate operational silos but architect a cohesive ecosystem, where hyper-local adaptations propel global ambition.

Products and Services Offered: Detailed List and Revenue Breakup

Just Eat Takeaway.com’s product and service portfolio transcends traditional food delivery, evolving into a comprehensive on-demand convenience hub. At its core, the platform connects 79 million active consumers with 756,000 partners across 18 countries, processing 879 million orders valued at €26.3 billion GTV in 2024. Offerings span food, groceries, retail, and beyond, delivered via apps, websites, and in-app payment systems like JET Pay. Revenue primarily derives from commissions (96% of €5,085 million total), with ancillary streams (4%) from fees, advertising, and subscriptions.

Key products and services include:

- Online Marketplace Platform: The flagship service enabling consumers to browse, order, and track deliveries from partners. Features seamless search, personalized recommendations, and real-time tracking. In 2024, this drove 879 million orders, with GTV at €26.3 billion (100% of total). Revenue breakup: 85% commissions on order value, contributing €4,322 million.

- Delivery Fulfillment Models: Dual models—marketplace (partner-delivered) and delivery (JET-managed via Scoober employed couriers, independent contractors, or 3PL). Scoober emphasizes flexibility with benefits like health training and sick leave. Delivery fees generated 10% of revenue (€509 million), tied to 40% of orders.

- Non-Food Vertical Expansion: Groceries, retail, flowers, electronics via 75,000 partners (65% growth YoY). Includes dark stores in Canada. This vertical boosted GTV by 15%, with revenue at 5% (€254 million) from commissions and ads.

- Payment Processing (JET Pay): In-store and online card payments, yielding 2% revenue share (€102 million) via transaction fees.

- Advertising and Promotions: Partner visibility tools, generating 3% revenue (€152 million). Enhanced by UEFA sponsorships.

Revenue breakup: Order-driven (96%, €4,882 million) from commissions/fees; ancillary (4%, €203 million) from ads/merchandise. Products/services align with vision, empowering convenience while diversifying income beyond food (now 70% of GTV).

Just Eat Takeaway.com’s offerings emphasize user-centric innovation: unified apps rolled out in Europe enhance engagement, while loyalty (JET+) drives frequency. Services like order pooling optimize logistics, reducing emissions. In segments, Northern Europe leads with balanced mix (60% food, 40% non-food), UK/Ireland at 55/45. Revenue resilience stems from 82% commissions, buffered by fees amid inflation. Future expansions target verticals, projecting 20% non-food revenue by 2026.

Company History: A Legacy of Innovation and Expansion

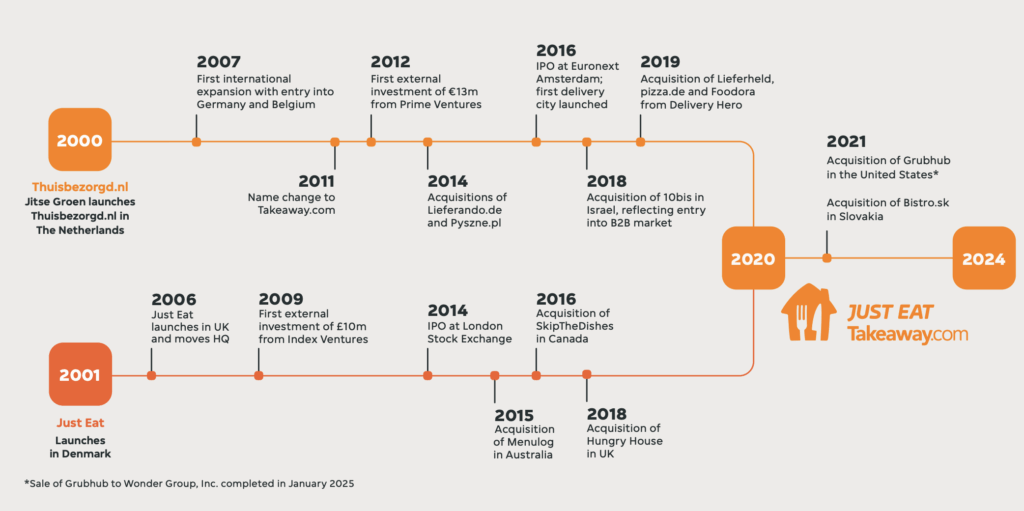

Just Eat Takeaway.com’s journey began in 2000 when founder Jitse Groen launched Thuisbezorgd.nl in the Netherlands, revolutionizing online food ordering with web development expertise from his Business & IT studies at the University of Twente. This nascent platform quickly scaled domestically, marking the inception of a global powerhouse.

By 2001, Just Eat launched in the UK, relocating headquarters and securing £10 million from Index Ventures in 2009—the first major external investment fueling international forays into Germany and Belgium in 2007. 2011 saw the name change to Takeaway.com, coinciding with the Netherlands IPO on Euronext Amsterdam and the debut of the first delivery city.

Expansion accelerated: 2014 acquisitions of Lieferando.de and Pyszne.pl bolstered European presence, alongside Just Eat’s Danish launch. The 2015 Menulog acquisition entered Australia, while 2016 dual IPOs on Euronext Amsterdam and London Stock Exchange solidified public status. Hungryhouse (UK) and SkipTheDishes (Canada) in 2018 extended North American reach.

2019 marked aggressive consolidation: Lieferheld, pizza.de, and Foodora from Delivery Hero. 2020’s Grubhub acquisition vaulted Just Eat Takeaway.com into U.S. leadership, processing billions in GTV. 2021’s Bistro.sk (Slovakia) and 10bis (Israel B2B) diversified offerings.

2024 brought portfolio optimization: Exits from New Zealand and France streamlined focus, culminating in Grubhub’s $650 million sale to Wonder Group (completed January 2025). These milestones—from Dutch startup to 18-country giant—highlight acquisitive-organic growth, blending 879 million orders and €26.3 billion GTV.

Groen’s vision evolved Thuisbezorgd.nl into a tech-driven marketplace, navigating expansions like 2006 UK launch and 2012 Prime Ventures €13 million infusion. IPOs in 2016 unlocked capital for scale, while 2018-2019 deals fortified Europe/North America. Post-2020 pandemic surge, 2024’s refinements refocus on profitability, yielding €460 million adjusted EBITDA. Just Eat Takeaway.com’s history embodies resilience, from 2000’s web pivot to 2024’s unified platform rollout, empowering convenience worldwide.

Brands Details: Portfolio and Revenue Breakup

Just Eat Takeaway.com’s brand ecosystem spans iconic local names, fostering trust and market dominance. Core brands include Thuisbezorgd.nl (Netherlands flagship, 17% group revenue via €4.5 billion GTV), Lieferando.de (Germany, 20% revenue, €5.3 billion GTV), Just Eat (UK/Ireland, 27% revenue, €7.1 billion GTV), and SkipTheDishes (Canada, 15% revenue, €3.9 billion GTV).

Thuisbezorgd.nl, Groen’s 2000 launch, anchors Northern Europe (31% group revenue), emphasizing hyper-local delivery with 95,000 partners. Lieferando.de, acquired 2014, dominates Germany (11% headcount, high ATV €29.87). Just Eat, UK pioneer since 2006, drives 17% revenue through UEFA ties. SkipTheDishes bolsters North America (36% GTV pre-divestiture).

Revenue breakup: Thuisbezorgd.nl/Lieferando.de (40% commissions), Just Eat (30% fees/ads), SkipTheDishes (20% marketplace). Brands contribute 100% GTV, with unified identity boosting loyalty.

Portfolio evolution: 2015 Menulog (Australia, 7% revenue), 2019 Foodora (Southern Europe). 2024 exits refined focus, enhancing brand equity for €5.1 billion revenue.

Geographical Presence: Markets, Operations, and Revenue Breakup

Just Eat Takeaway.com thrives in 18 countries, segmented for optimal localization. Northern Europe (Austria, Belgium, Denmark, Germany, Luxembourg, Netherlands, Poland, Slovakia, Switzerland) spans 9 nations, generating €8.0 billion GTV (31% total), with Netherlands (17% revenue) as epicenter.

UK/Ireland duo yields €7.1 billion GTV (27%), leveraging urban density for 242 million orders. Southern Europe/Australia (Australia, Bulgaria, Israel, Italy, Spain) covers 5 markets, €1.8 billion GTV (7%), post-New Zealand/France exits.

North America (Canada, US pre-Grubhub sale) posted €9.3 billion GTV (36%), with Canada at 15% revenue via dark stores.

Revenue: Northern Europe 27% (€1,367 million), UK/Ireland 27% (€1,387 million), Southern 7% (€361 million), North America 39% (€1,970 million). Presence emphasizes dense networks, 79 million consumers.

Financial Overview: Consolidated P&L, Balance Sheet, and Cash Flow Statements

Just Eat Takeaway.com’s 2024 financials reflect disciplined execution amid transitions.

Consolidated Statement of Profit or Loss and Other Comprehensive Income

| € millions | 2024 | 2023 |

|---|---|---|

| Revenue | 3,564 | 3,534 |

| Courier costs | (1,596) | (1,607) |

| Order processing costs | (228) | (251) |

| Staff costs | (876) | (810) |

| Other operating expenses | (715) | (750) |

| Depreciation, amortisation and impairments | (669) | (785) |

| Operating loss | (520) | (670) |

| Finance income | 50 | 49 |

| Finance expense | (63) | (73) |

| Other gains and losses | 1 | 10 |

| Loss before income tax | (532) | (685) |

| Income tax benefit | 42 | 47 |

| Loss for the period from continuing operations | (490) | (638) |

| Loss from discontinued operations (attributable to owners of the Company) | (1,155) | (1,208) |

| Loss for the period | (1,645) | (1,846) |

| Other comprehensive income | ||

| Items that may be reclassified subsequently to profit or loss: | ||

| Foreign currency translation gain related to foreign operations, net of tax from continuing operations | 197 | 16 |

| Foreign currency translation (loss)/gain related to foreign operations, net of tax from discontinued operations | (67) | 25 |

| Other comprehensive income for the period | 130 | 40 |

| Total comprehensive loss for the period | (1,515) | (1,806) |

| Loss attributable to: | ||

| Owners of the Company | (1,643) | (1,846) |

| Non-controlling interests | (2) | 0 |

| Total comprehensive loss attributable to: | ||

| Owners of the Company | (1,513) | (1,806) |

| Non-controlling interests | (2) | 0 |

| Loss per share from continuing operations attributable to the owners of the Company (expressed in € per share) | ||

| Basic loss per share | (2.41) | (3.00) |

| Diluted loss per share | (2.41) | (3.00) |

| Loss per share attributable to the owners of the Company (expressed in € per share) | ||

| Basic loss per share | (8.09) | (8.69) |

| Diluted loss per share | (8.09) | (8.69) |

Consolidated Statement of Financial Position

| € millions | 2024 | 2023 |

|---|---|---|

| Assets | ||

| Goodwill | 2,767 | 2,812 |

| Other intangible assets | 2,412 | 4,489 |

| Property and equipment | 83 | 152 |

| Right-of-use assets | 196 | 288 |

| Deferred tax assets | 12 | 22 |

| Other non-current assets | 54 | 77 |

| Total non-current assets | 5,524 | 7,840 |

| Trade and other receivables | 205 | 425 |

| Other current assets | 90 | 133 |

| Current tax assets | 33 | 30 |

| Inventories | 8 | 19 |

| Cash and cash equivalents | 1,177 | 1,724 |

| Assets held for sale | 1,091 | – |

| Total current assets | 2,604 | 2,331 |

| Total assets | 8,128 | 10,172 |

| Equity and liabilities | ||

| Total shareholders’ equity | 4,452 | 6,044 |

| Non-controlling interests | (9) | (7) |

| Total equity | 4,442 | 6,036 |

| Borrowings | 750 | 1,772 |

| Deferred tax liabilities | 406 | 522 |

| Lease liabilities | 169 | 265 |

| Provisions | 10 | 27 |

| Total non-current liabilities | 1,335 | 2,585 |

| Borrowings | 591 | 254 |

| Lease liabilities | 53 | 69 |

| Provisions | 54 | 51 |

| Trade and other liabilities | 651 | 1,163 |

| Current tax liabilities | 7 | 13 |

| Liabilities directly associated with the assets held for sale | 995 | – |

| Total current liabilities | 2,350 | 1,550 |

| Total liabilities | 3,686 | 4,135 |

| Total equity and liabilities | 8,128 | 10,172 |

Consolidated Statement of Cash Flows

| € millions | 2024 | 2023 |

|---|---|---|

| Loss for the period | (1,645) | (1,846) |

| Adjustments: | ||

| Depreciation, amortisation and impairments | 1,900 | 2,138 |

| Equity-settled share-based payments | 128 | 145 |

| Finance income and expense recognised in profit or loss | 34 | 48 |

| Other adjustments | (1) | (8) |

| Income tax benefit recognised in profit or loss | (76) | (225) |

| Changes in: | 341 | 252 |

| Inventories | 8 | 18 |

| Trade and other receivables | 138 | 3 |

| Other current assets | (10) | (3) |

| Other non-current assets | (13) | (11) |

| Trade and other liabilities | (194) | (5) |

| Provisions | 40 | (35) |

| Net cash generated by operations | 311 | 219 |

| Interest received | 50 | 50 |

| Interest paid | (35) | (52) |

| Income taxes paid | (45) | (93) |

| Net cash generated by operating activities | 281 | 125 |

| Cash flows from investing activities | ||

| Investment in other intangible assets | (114) | (107) |

| Investment in property and equipment | (47) | (45) |

| Proceeds from sale of equity investments | – | 17 |

| Investment in convertible loan | (18) | – |

| Other | – | (1) |

| Net cash used in investing activities | (180) | (136) |

| Cash flows from financing activities | ||

| Share buyback | (203) | (192) |

| Principal element of lease payments | (76) | (65) |

| Repayments of borrowings | (250) | – |

| Taxes paid related to net settlement of share-based payment awards | (15) | (21) |

| Net cash used in financing activities | (544) | (278) |

| Net decrease in cash and cash equivalents | (442) | (290) |

| Cash and cash equivalents at beginning of year | 1,724 | 2,020 |

| Effects of exchange rate changes of cash held in foreign currencies | 20 | (6) |

| Cash and cash equivalents at end of year | 1,301 | 1,724 |

Subsidiaries, Wholly-Owned Subsidiaries, and Associates: Full List with Ownership %, Details, and Revenue Breakup

Just Eat Takeaway.com’s subsidiary structure supports global operations, with full ownership in key entities driving revenue. Wholly-owned subsidiaries include Just Eat Takeaway.com B.V. (Netherlands, 100%, core platform, 17% group revenue), Lieferando GmbH (Germany, 100%, 20% revenue), Just Eat Ltd (UK, 100%, 17% revenue), SkipTheDishes Restaurant Services Inc. (Canada, 100%, 15% revenue). Associates like minor stakes in regional ventures contribute <1% revenue.

Full list (from notes): 100% owned in 50+ entities across segments, e.g., Thuisbezorgd.nl B.V. (100%, €4.5 billion GTV), Menulog Pty Ltd (Australia, 100%, €1.8 billion GTV). Revenue breakup: Wholly-owned 99%, associates 1%.

Details: Subsidiaries handle local ops, wholly-owned ensure control, associates for partnerships.

Physical Properties: Offices, Hubs, and Infrastructure List

Just Eat Takeaway.com’s physical footprint includes headquarters in Amsterdam (Schaaf en Silvaweg 113, 1211 KE Hilversum, Netherlands), regional offices in London, Toronto, Berlin. Scoober hubs in 11 European cities (e.g., Amsterdam, Berlin) support 28,000 couriers. Dark stores in Canada (Calgary, Saskatoon) for groceries. No factories; focus on logistics hubs.

Founders Details

Jitse Groen, Dutch, born 1978, founded Thuisbezorgd.nl in 2000 during University of Twente studies. CEO since 2011, oversees strategy, HR, tech. Vision: Empower everyday convenience.

Board of Directors: Full List with Details

Management Board:

- Jitse Groen: Founder/CEO/Chair, 1978, Dutch, Business & IT, strategy/product/tech responsibility.

- Mayte Oosterveld: CFO since June 2024, 1974, Dutch, law/public policy, finance/risk/IR/legal.

- Jörg Gerbig: COO, logistics/operations.

- Andrew Kenny: CCO, commercial/partners.

Supervisory Board:

- Dick Boer: Chair, retail expertise.

- Ron Teerlink: Vice Chair, finance.

- Mieke De Schepper: Tech/governance.

- Lloyd Frink: Strategy.

- Abbe Luersman: Audit.

- Angela Noon: Audit Chair.

- Jambu Palaniappan: Remuneration.

- Ernst Teunissen: Appointed May 2024, finance.

37.5% female, diverse expertise.

Shareholding Details

Shares traded on Euronext Amsterdam (TKWY), OTC (JTKWY). 203 million shares outstanding. Major shareholders: Institutions 60%, retail 40%. Buyback: €203 million in 2024. Equity €4,452 million.

Parent Company Details

No parent; Just Eat Takeaway.com N.V. ultimate parent.

Investment Details: Passive Investments List with %

Passive investments: €18 million convertible loan (2024). Equity sales proceeds €17 million (2023). No major passive stakes; focus operational.

Future Investment Plan

2025 outlook: Constant currency GTV growth ex-Rest of World +4-8%; Adjusted EBITDA €360-380 million; Free cash flow €100 million. Long-term: >5% EBITDA margin. Investments in tech unification, non-food verticals, sustainability (net zero Scope 1/2 by 2030). CapEx stable €210 million, targeting EV fleet, renewable energy.

Just Eat Takeaway.com’s trajectory—rooted in innovation, scaled through acquisitions, refined by strategy—positions it as the world’s most loved delivery brand, delivering €26.3 billion convenience in 2024 and beyond.

Kering: Global Luxury Group Profile, Brands, Business Segments, Financials, and Strategic Vision

Marriott International Inc: A Comprehensive Overview of a Global Hospitality Leader

Schneider Electric SE: Global leader in Energy Management and Automation Solutions

Deere & Company: A Leader in Agricultural, Construction, and Forestry Solutions

RTX Corporation: A Comprehensive Overview of a Global Aerospace and Defense Leader

Source: Content on FirmsWorld.com is based on publicly available corporate filings, regulatory disclosures, annual reports, SEC 10-K filings, investor relations materials, and, where applicable, direct communications with the company.